Business Insurance in and around Maryville

One of the top small business insurance companies in Maryville, and beyond.

Cover all the bases for your small business

Business Insurance At A Great Value!

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Hunter Jones recognizes the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to consider.

One of the top small business insurance companies in Maryville, and beyond.

Cover all the bases for your small business

Protect Your Business With State Farm

If you're looking for a business policy that can help cover business property, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

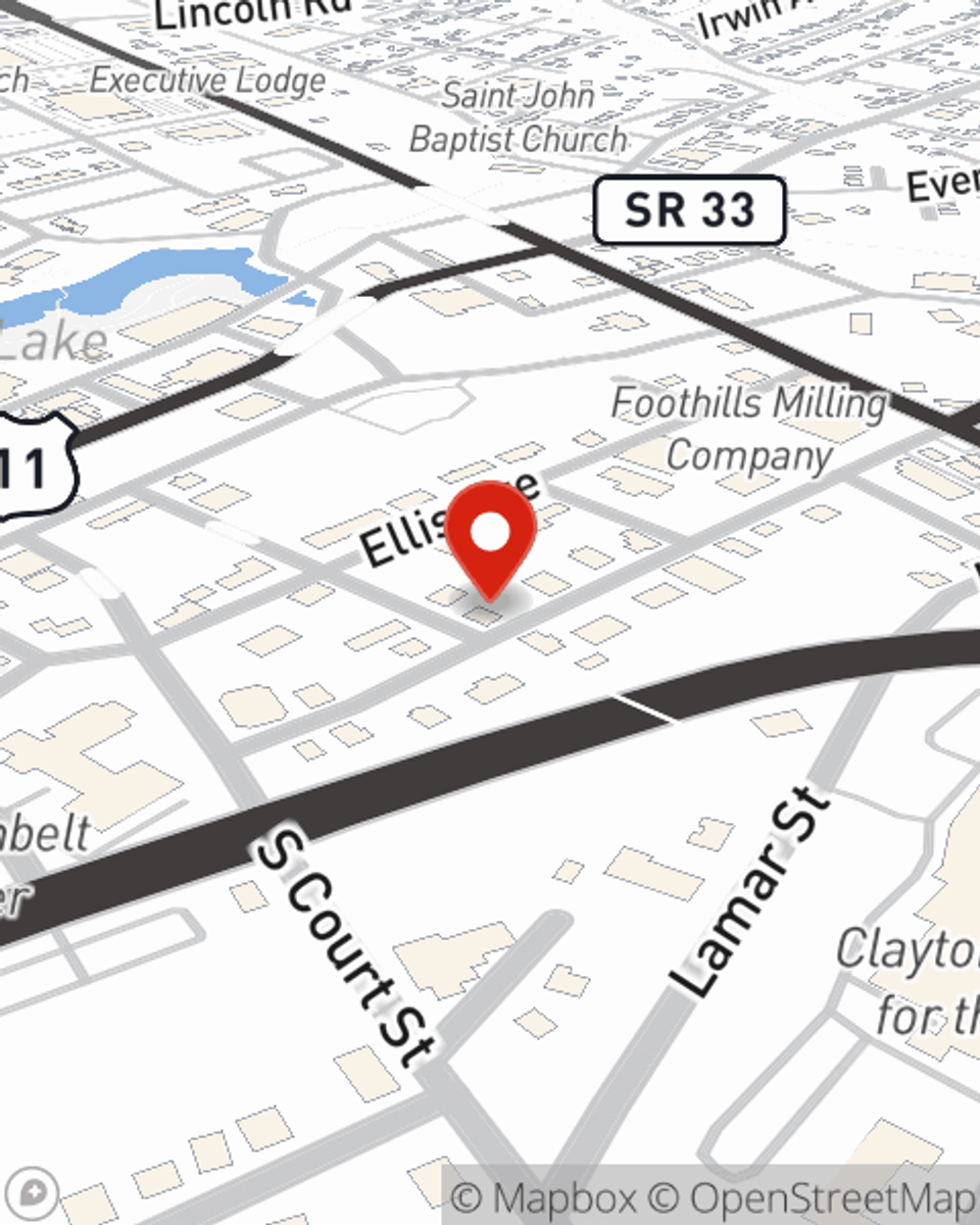

At State Farm agent Hunter Jones's office, it's our business to help insure yours. Call or email our terrific team to get started today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Hunter Jones

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.